The Departemen Layanan Digital dan Keamanan Siber Bank Indonesia is at the forefront of digital transformation and cybersecurity in the Indonesian banking sector. With a mission to enhance digital services and safeguard the industry from cyber threats, the department plays a pivotal role in shaping the future of digital banking in the country.

Through its initiatives, collaborations, and regulations, the department has been instrumental in promoting innovation, protecting customer data, and fostering a secure and trusted digital banking ecosystem.

Overview of the Department of Digital Services and Cybersecurity, Bank Indonesia

The Department of Digital Services and Cybersecurity (DDS&C) at Bank Indonesia plays a critical role in safeguarding the nation’s financial system and fostering digital innovation.

The department’s mission is to ensure the stability, efficiency, and security of Indonesia’s financial infrastructure through the implementation of advanced digital technologies and robust cybersecurity measures.

Vision, Departemen layanan digital dan keamanan siber bank indonesia

The department envisions a digital financial ecosystem in Indonesia that is secure, resilient, and inclusive.

Goals

- Enhance the efficiency and accessibility of financial services through digital transformation.

- Protect the financial system from cyber threats and vulnerabilities.

- Foster innovation and collaboration in the digital financial space.

Structure and Responsibilities

The DDS&C is organized into several divisions, each with specific responsibilities:

- Digital Services Division:Develops and implements digital financial services, including mobile banking, electronic payments, and digital onboarding.

- Cybersecurity Division:Monitors and responds to cyber threats, implements security measures, and conducts vulnerability assessments.

- Policy and Regulation Division:Develops and implements policies and regulations related to digital services and cybersecurity.

- Research and Development Division:Conducts research on emerging technologies and best practices in digital services and cybersecurity.

History

The DDS&C was established in 2018 in response to the growing need for digital transformation and cybersecurity in the financial sector. Since its inception, the department has played a pivotal role in advancing Indonesia’s digital financial landscape while safeguarding the integrity of the nation’s financial system.

Digital Transformation Initiatives

The Department of Digital Services and Cybersecurity plays a pivotal role in fostering digital transformation within the Indonesian banking sector. The department’s mission is to promote the adoption of innovative technologies, enhance the digital capabilities of banks, and improve the overall customer experience.

To achieve these goals, the department has undertaken several key initiatives and projects:

Regulatory Framework

- Developed and implemented regulations to govern the use of digital technologies in the banking sector.

- Established guidelines for banks to ensure the secure and responsible adoption of digital services.

Digital Infrastructure

- Established a national digital payment infrastructure that enables seamless and secure transactions across banks.

- Developed a digital identity system to facilitate secure and convenient access to financial services.

Capacity Building

- Provided training and technical assistance to banks to enhance their digital capabilities.

- Established a digital transformation center to support banks in their digital transformation journey.

Case Studies

- Bank Mandiri: Successfully implemented a mobile banking platform that provides a comprehensive range of financial services.

- BCA: Deployed a digital lending platform that significantly reduced loan processing time and improved customer satisfaction.

- BNI: Established a digital ecosystem that integrates various banking services with e-commerce and lifestyle platforms.

Cybersecurity Measures and Regulations: Departemen Layanan Digital Dan Keamanan Siber Bank Indonesia

The Department of Digital Services and Cybersecurity plays a critical role in safeguarding the Indonesian banking sector from cyber threats. Its mandate includes developing cybersecurity regulations and frameworks, monitoring the implementation of cybersecurity measures, and coordinating with other stakeholders to enhance the overall cybersecurity posture of the industry.

Bank Indonesia’s Digital Services and Cybersecurity Department plays a crucial role in ensuring the cybersecurity of the nation’s financial system. As discussed in keamanan siber tanggung jawab siapa , cybersecurity is a shared responsibility. The department collaborates with various stakeholders to implement robust cybersecurity measures, safeguarding the financial infrastructure and protecting sensitive data.

The department has developed a comprehensive set of cybersecurity regulations and frameworks to guide banks in protecting their systems and data. These include:

- Bank Indonesia Regulation No. 18/17/PBI/2016 on Information Technology Risk Management for Banks

- Bank Indonesia Regulation No. 19/12/PBI/2017 on Cybersecurity Incident Management for Banks

- Bank Indonesia Regulation No. 21/14/PBI/2019 on Information Security Management System for Banks

These regulations Artikel the minimum requirements for banks to establish and maintain effective cybersecurity programs, including measures for:

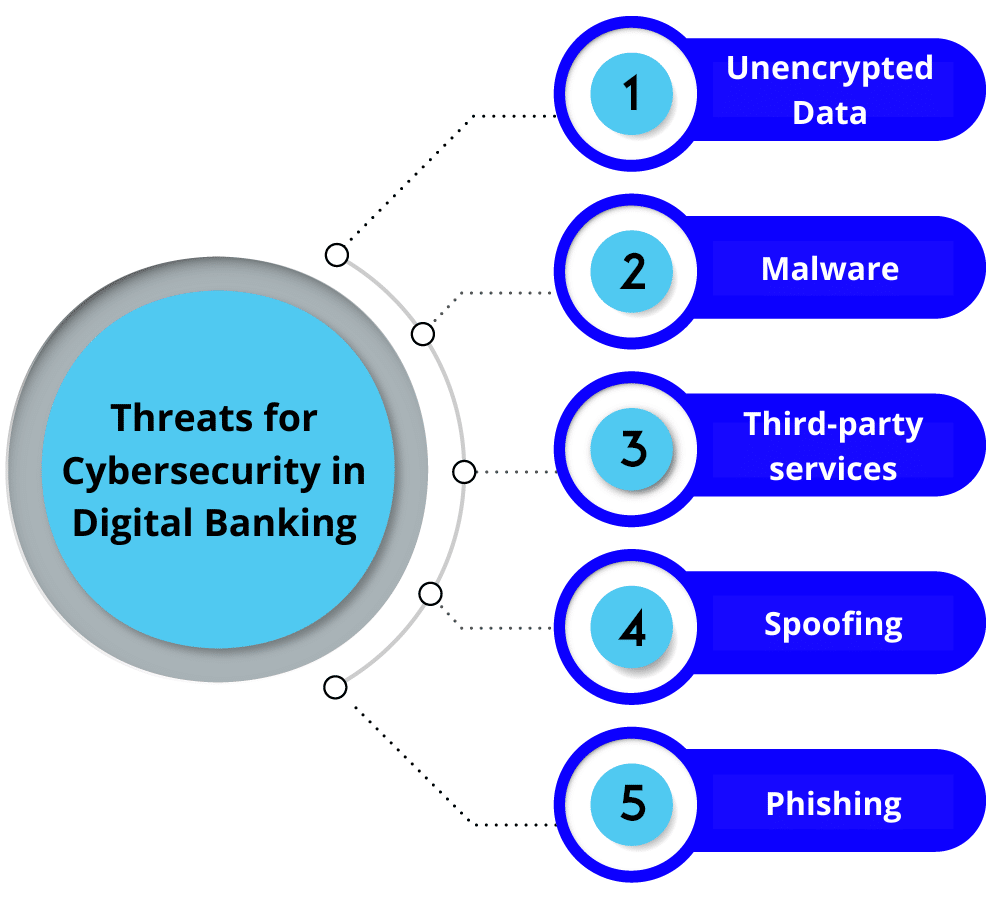

- Identifying and assessing cybersecurity risks

- Implementing appropriate cybersecurity controls

- Responding to and recovering from cybersecurity incidents

- Continuously monitoring and improving cybersecurity posture

In addition to these regulations, the department also provides guidance and support to banks on cybersecurity best practices. It conducts regular workshops and training programs to help banks build their cybersecurity capabilities. The department also works closely with other stakeholders, such as the Indonesian National Cyber and Crypto Agency (BSSN), to coordinate cybersecurity efforts and share information on emerging threats.

As a result of these efforts, Indonesian banks have made significant progress in strengthening their cybersecurity defenses. Banks have implemented a wide range of cybersecurity measures, including:

- Multi-factor authentication

- Encryption of sensitive data

- Intrusion detection and prevention systems

- Regular security audits and penetration testing

- Employee cybersecurity awareness training

These measures have helped to protect customer data and financial assets from cyber threats and have contributed to the overall stability of the Indonesian banking sector.

Collaboration and Partnerships

The Department of Digital Services and Cybersecurity at Bank Indonesia fosters strategic partnerships with various stakeholders to drive the development and implementation of digital services and cybersecurity measures. These collaborations enable the department to leverage expertise, share best practices, and address industry challenges collectively.

Partnerships with government agencies, such as the Ministry of Communication and Informatics and the Financial Services Authority, facilitate the alignment of regulatory frameworks and the coordination of cybersecurity initiatives. Industry stakeholders, including banks, fintech companies, and technology providers, contribute their domain knowledge and expertise to shape digital services that meet the evolving needs of the banking sector.

International Collaborations

The department actively engages with international organizations, such as the Bank for International Settlements (BIS) and the World Bank, to exchange knowledge, share best practices, and contribute to the development of global standards for digital services and cybersecurity. These collaborations enhance Indonesia’s standing in the international banking community and ensure that the country remains at the forefront of digital transformation.

Success Stories

The department’s collaborative efforts have resulted in several successful initiatives that have significantly enhanced the banking sector’s digital ecosystem:

- The development of a national digital payment platform, which has accelerated the adoption of digital payments and financial inclusion in Indonesia.

- The establishment of a cybersecurity information sharing platform, which enables banks and other financial institutions to share threat intelligence and respond to cybersecurity incidents effectively.

- The implementation of a regulatory sandbox, which provides a safe environment for banks to test and innovate new digital services, fostering competition and innovation in the banking sector.

Future Outlook and Challenges

The digital banking landscape is constantly evolving, with emerging trends and challenges shaping the industry. To stay ahead, the Department of Digital Services and Cybersecurity at Bank Indonesia is actively monitoring these developments and adapting its strategies accordingly.

Emerging Trends

- Increased adoption of mobile banking and digital payments

- Growing popularity of fintech and challenger banks

- Advancements in artificial intelligence (AI) and machine learning (ML)

Challenges

- Cybersecurity threats, including data breaches and phishing attacks

- Regulatory compliance with evolving data privacy and security regulations

- Need for skilled professionals in digital banking and cybersecurity

Department’s Plans and Strategies

To address these challenges and shape the future of digital services and cybersecurity in Indonesia, the department has developed several key plans and strategies:

- Strengthening cybersecurity measures:Implementing advanced technologies and partnering with cybersecurity experts to enhance protection against cyber threats.

- Promoting regulatory compliance:Working with banks and other stakeholders to ensure compliance with data privacy and security regulations.

- Investing in digital infrastructure:Upgrading and expanding digital infrastructure to support the growing demand for digital banking services.

- Developing skilled professionals:Collaborating with universities and training institutions to create a skilled workforce in digital banking and cybersecurity.

Opportunities for Innovation and Growth

These challenges also present opportunities for innovation and growth in the banking sector:

- Personalized banking experiences:Leveraging AI and ML to provide tailored financial products and services to customers.

- New revenue streams:Exploring new digital products and services, such as mobile wallets and online lending platforms.

- Increased financial inclusion:Using digital banking to reach underserved populations and promote financial literacy.

By embracing these opportunities and addressing the challenges ahead, the Department of Digital Services and Cybersecurity at Bank Indonesia aims to drive innovation, enhance cybersecurity, and shape the future of digital banking in Indonesia.

Ending Remarks

As the banking landscape continues to evolve, the Departemen Layanan Digital dan Keamanan Siber Bank Indonesia remains committed to its mission of driving digital transformation and ensuring cybersecurity. By embracing emerging technologies, fostering collaboration, and staying abreast of the latest threats, the department is well-positioned to guide the Indonesian banking sector towards a future of innovation, security, and growth.

FAQ Section

What is the primary responsibility of the Departemen Layanan Digital dan Keamanan Siber Bank Indonesia?

To promote digital transformation and safeguard the Indonesian banking sector from cybersecurity threats.

What are some key initiatives undertaken by the department?

Developing cybersecurity regulations, promoting digital payment systems, and fostering innovation in the banking sector.

How does the department collaborate with other stakeholders?

Through partnerships with government agencies, industry associations, and international organizations to enhance digital services and cybersecurity measures.